Asset Turnover Ratio Standard

The inventory turnover is 3. A ratio may serve as an indicator red flag or clue for various issues.

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

Dividend Payout Ratio Standard Deviation Compound Annual Growth Rate CAGR Discounted Cash Flow DCF Cost of Goods Sold.

. Conversely if the ratio is lower it indicates that the company is not using its assets efficiently. These are costs the investor pays through a reduction in the investments rate of return. Trade payables turnover ratio or Accounts payable turnover ratio depicts the efficiency with which the business makes payment.

Accounts Receivable Turnover Net Sales Average Accounts Receivable Days in Accounts Receivable Average Accounts Receivable Sales x 365 Number of times trade receivables turnover during the year. Exp Ratio Gross Expense ratio is a measure of what it costs to operate an investment expressed as a percentage of its assets as a dollar amount or in basis points. Both of these metrics are based on.

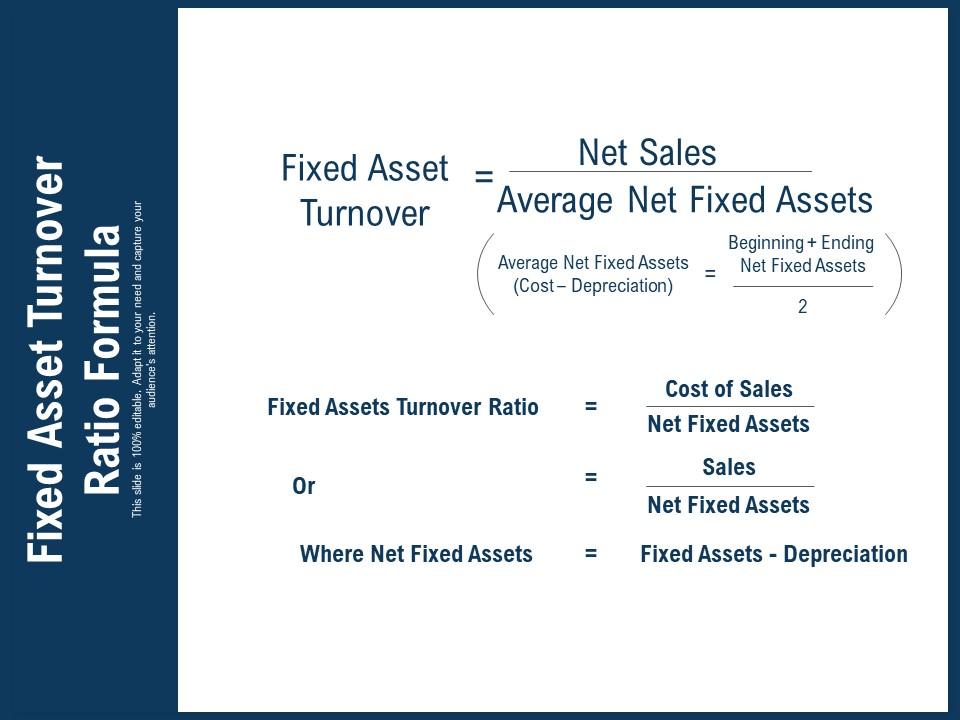

Fixed Asset Turnover Ratio. Asset class differences in weightings and increased portfolio risk relative to. This suggested that the company was using its assets more efficiently as compared to the industry for generating sales.

Expense ratio 1 004 Dividend schedule Quarterly ETF total net assets 94740 million Fund total net assets 139265 million Inception date January 26 2004 Trading information Ticker symbol VTV CUSIP number 922908744 IIV intra-day ticker VTVIV Index ticker Bloomberg CRSPLCVT Exchange. Although a lower percentage is always better than a higher one there is no standard percentage across industries. More Funds from Mirae Asset Mutual Fund Out of 24 mutual fund schemes offered by this AMC 4 isare ranked 4 7 isare ranked 3 1 isare ranked 1 and 12 schemes are not ranked.

TIPS over the long term. In the second example well use the same company and the same scenario as above but this time compute the average inventory period meaning how long it will take to sell the inventory currently on hand. We already know the inventory turnover.

SSGAs expectations for future returns risk and correlations across the included asset classes and cannot be guaranteed. This ratio is used as a guide to optimising the firms assets inventory and accounts receivable collection on a regular basis. Motorolas debt ratio as well as debt to equity ratio was higher than the industry average.

Under the new standard other accounting changes include accounting for sub-leases lease modifications and. Net asset value NAV return 3-1028 -939 -189 864 921 1177 819. 2 Virtually all leases will be capitalised except for exempted short-term leases and low value asset leases.

For a mutual fund the gross expense ratio is the total annual fund or class operating. The higher the turnover the shorter the time. The Funds asset class exposures are rebalanced on a quarterly basis.

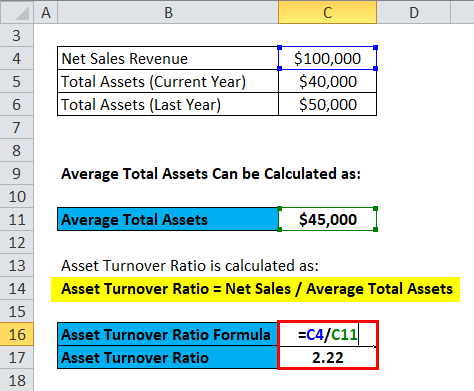

This ratio is used to measure the number of times the business is paying off its creditors or suppliers in an accounting period. The standard asset turnover ratio considers all asset classes including current assets long-term assets and other assets. Asset Turnover Ratio is a measure that is used to determine how efficiently a company is generating revenues from its assets.

Hence a higher ratio for asset turnover is a good sign that the company is using its assets efficiently. By standard deviation similar to longer-dated US. The two common assets are.

To calculate your accounts receivable. 3 Right-of-use asset that meets the definition of investment property IP are required to be presented as IP in the BS. It is an indicator of the efficiency with which a company is deploying its assets to produce the revenue.

Assume you have 100000. Accounts payables are short term debts that a business owes to its suppliers and creditors. There are five types of financial ratio.

Since large funds have different cost structures than smaller funds and different investment industries require more qualified professionals its difficult to calculate a standard percentage. We get official financial reports of public companies and present them according to US. Updated Dec 03 2021.

To calculate your accounts receivable turnover ratio divide your net sales by your average gross receivables. A decreasing ratio is considered desirable since it generally indicates increased efficiency. The higher the ratio the better is the companys.

Total Assets A common variation of the asset turnover ratio is. The inventory holding at the beginning of the year and at the end of the year stood at 300 million and 320 million. Both fixed asset as well as total asset turnover ratio for Motorola was higher than the industry average.

Types of Financial Ratios. Calculating Accounts Receivable Turnover. Asset turnover ratio is the ratio between the value of a companys sales or revenues and the value of its assets.

During 2018 the company incurred the raw material cost of 150 million the direct labor cost of 120 million and the manufacturing overhead cost of 30 million. Thus asset turnover ratio can be a determinant of a companys performance. There are various reasons for which the asset.

GAAP clearly and appropriately for further research and analysis for example Microsoft reportsAs you know each companys financial statements look different so we have done a lot of work to convert them to the standard form according to the latest US. Lets take a look at an example. This pointed towards the.

To find the inventory turnover ratio we divide 47000 by 16000. Let us take the example of a company to demonstrate the stock turnover ratio concept.

Fixed Asset Turnover Ratio Formula Powerpoint Shapes Powerpoint Slide Deck Template Presentation Visual Aids Slide Ppt

Asset Turnover Ratio Formula Calculator Excel Template

Asset Turnover Ratio Formula Calculator Excel Template

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

0 Response to "Asset Turnover Ratio Standard"

Post a Comment